Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- 【XM Market Analysis】--Silver Forecast: Looking for Support

- 【XM Market Analysis】--Gold Analysis: Will Prices Rise in the Coming Days?

- 【XM Decision Analysis】--USD/MYR Analysis: Near Highs Amid Pre-Fed Caution

- 【XM Group】--AUD/USD Forex Signal: Pullback Likely Ahead of ADP Jobs Data

- 【XM Market Analysis】--USD/MXN Analysis: Volatile Higher Range as Mexico Braces f

market analysis

PCEs follow after the Fed restarts interest rate cuts, and gold may continue to be strong?

Wonderful introduction:

A clean and honest man is the happiness of honest people, a prosperous business is the happiness of businessmen, a punishment of evil and traitors is the happiness of chivalrous men, a good character and academic performance is the happiness of students, aiding the poor and helping the poor is the happiness of good people, and planting in spring and harvesting in autumn is the happiness of farmers.

Hello everyone, today XM Foreign Exchange will bring you "[XM Foreign Exchange]: PCE will follow after the Federal Reserve restarts interest rate cuts, may gold continue to be strong?" Hope it will be helpful to you! The original content is as follows:

After the Federal Reserve's decision to cut interest rates was released, gold and silver continued to perform strongly. The focus of the market this week will turn to Friday's PCE data and the prospect of a fourth-quarter rate cut. In addition, the Swiss National Bank will announce its interest rate decision this Thursday.

Market Review last week

The Federal Reserve restarted interest rate cuts last week, and the interest rate range dropped to 4%-4.25%, which is in line with market expectations, but internal differences still exist. Milan, who has just been nominated as a director by Trump, advocates a 50 basis point rate cut, while the dot chart shows that 10 people support the rate cut three or more times this year, while 9 people believe that it should be less than three times. The economic outlook also raised its growth forecast for 25-27 years, lowered its unemployment rate forecast for next two years, and raised its inflation expectations for next two years. The meeting statement once again emphasized the downward risks of the employment market. The current interest rate market is expected to have a 93% chance of another rate cut in October.

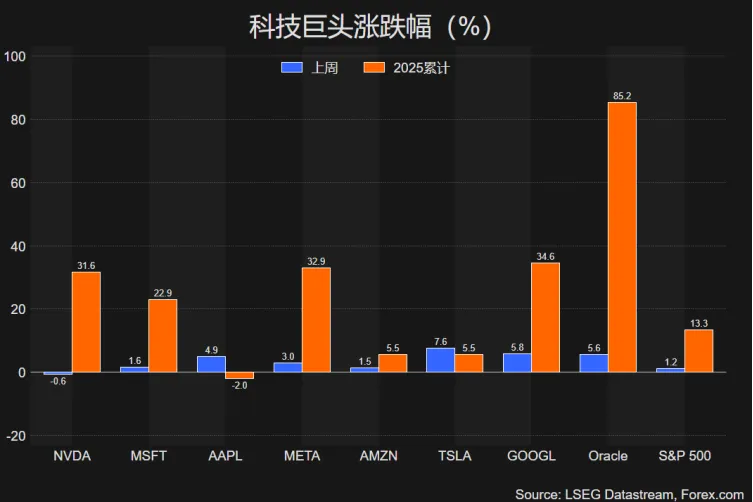

After the decision to cut interest rates was released, all three major U.S. stock indexes hit record highs last week, and the Russell 2000 index, which tracks small-cap stocks, also hit new highs simultaneously. Technology giants regained momentum. Weekly gains generally higher than the broader market index. Major European stock indexes closed slightly lower last week, while the Asia-Pacific market continued to perform hotly, with the Nikkei breaking through 45,000 points and setting a new high.

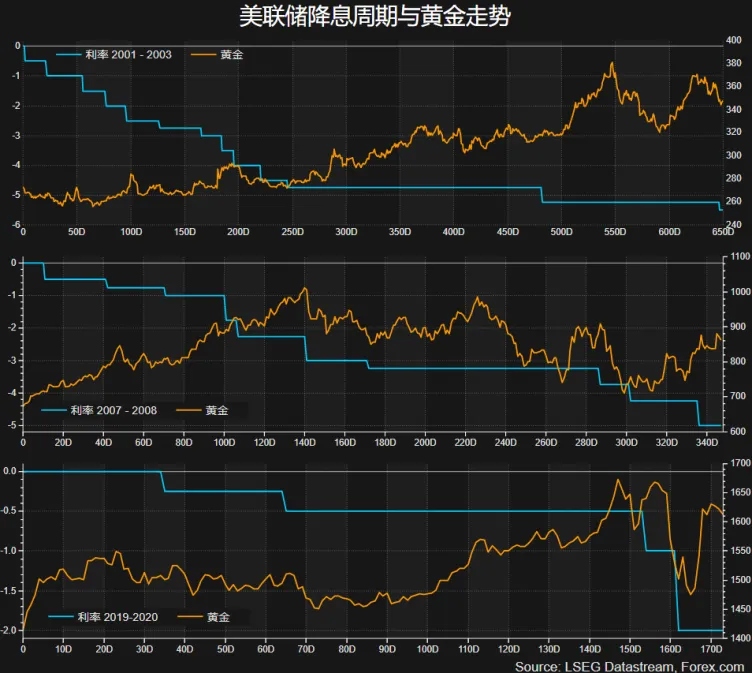

The interest rate cut continues to provide impetus for gold bulls. The gold price rose for five consecutive weeks and closed at $3,685. Silver also stood at the $43 mark and set a new 14-year high.

As the Fed's statement and economic outlook did not show excessive pessimistic expectations, this helped the US dollar index stop falling on the weekly basis and is expected to rebound in the short term, but from the technical perspective, the upper space is limited, and due to the obvious differences between the interest rate policies of major central banks such as Europe, the UK (suspension of interest rate cuts) and Japan (sustaining interest rate hikes within the year), the medium-term trend of the US dollar is still worrying. The trade war initiated by Trump has made "de-dollarization" the mainstream expectation of the financial market in a longer period of time.

Among non-US currencies, the Canadian dollar led the rise last week, the New York dollar and the Australian dollar ranked among the top, while the euro and the British pound Continued to fall slightly due to their respective fiscal difficulties, the US, Japan and Japan rebounded after a mid-week drop of 145.50 and closed close to 148.

The Bank of Japan kept interest rates unchanged last week, but two members favored interest rate hikes, and the Prime Minister’s popular candidate expressed support for interest rate hikes. The interest rate market shows that the probability of interest rate hikes this year is higher than 50%.

Outlook for this week

·U.S. PCE price index in August—Friday 20:30

Although the Fed is currently paying more attention to the dynamics of the job market, PCE this Friday may become the first important data to influence the prospects of interest rate cuts in the fourth quarter.

>The market generally expects that the PCE will rise from 2.6% to 2.7%, and the core PCE is expected to remain at 2.9%. If the data is lower than expected, the market may fully price the two interest rate cuts in October and December, which may bring sustained momentum to US stocks and gold. On the contrary, if inflation unexpectedly rises, the above-mentioned interest rate cuts may temporarily cool down, which will constitute a temporary positive for the US dollar.

Other U.S. economic data this week also includes the durable goods orders and the number of initial unemployment claims on Thursday. In addition, many Fed members will speak this week.

·Swiss National Bank rate resolution—Thursday 15:30

Swiss The central bank lowered the policy interest rate to 0% in June, setting the lowest benchmark interest rate among major central banks. It is expected to keep interest rates unchanged this week. Whether it implies a return to negative interest rates is the focus of market attention, but the interest rate market believes that the central bank has ended this round of interest rate cuts.

Inflation near zero in Switzerland and the strong appreciation of the Swiss franc are the main reasons for the central bank's aggressive interest rate cuts this year. Driven by risk aversion sentiment, the Swiss franc has appreciated 14% against the US dollar this year. If the central bank downplays the discussion of "negative interest rates", the Swiss franc is expected to continue its strength.

XAUUSD1 hour

Under the impact of the Federal Reserve restarting interest rate cuts and safe-haven demand (economic slowdown, rising inflation, geopolitical, etc.), the upward trend of gold is expected to continue.

However, gold prices are close to around 3700 at the hourly level, there is a possibility of slowing down or overbought adjustments, butIn a situation where bulls still have www.xmtraders.complete dominance, the downside space may be very limited. Focus on the potential support near the trend line below 3665/75. If it can break through 3700 strongly, it will open up new upward space. On the contrary, if the surge fails and falls under the key support area of 3628/38, it increases the probability of high-level oscillation.

The implied volatility of gold in one week is 14.36%, which means that the gold price is likely to fluctuate between 3610.24-3759.92 this week, that is, the range of US$75 each closing price last Friday.

AUDUSD4 hours

From the 4-hour chart, the Australian dollar has an oversold signal, and the short-term rebound may be brewing. However, unlike the previous two RSI oversold situations, the starting point of the Australian dollar decline of 0.6700 is exactly where the ultra-long-term downward trend line and the 200-week moving average overlap. Therefore, from the daily level, there may be a possibility of continuing to run downward. Pay attention to the previous low positions such as 0.6420 and 0.6370 below.

Follow the Australian August CPI data this Wednesday. The RBA meeting on September 30 is expected to keep interest rates unchanged, but the market expects the probability of interest rate cuts on November 4 to be more than 60%, and the quarterly CPI on October 29 was key before that.

The above content is all about "[XM Forex]: PCEs follow after the Fed restarts interest rate cuts, may gold continue to be strong?". It is carefully www.xmtraders.compiled and edited by the editor of XM Forex. I hope it will be helpful to your trading! Thanks for the support!

Only the strong know how to fight; the weak are not qualified to fail, but are born to be conquered. Step up to learn the next article!

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here