Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- 【XM Group】--CHF/JPY Forecast: Swiss Franc Powers Higher Against Japanese Yen

- 【XM Market Review】--GBP/USD Forex Signal: Rising Wedge, Death Cross Patterns For

- 【XM Group】--EUR/USD Forex Signal: Bullish Breakout Beyond $1.0387

- 【XM Decision Analysis】--GBP/USD Forecast: British Pound Continues to Stall

- 【XM Decision Analysis】--EUR/USD Analysis: Downward Trend Strong

market news

The daily line rises and reverses the hammer head, try to short when gold and silver are high

Wonderful introduction:

Spring flowers will bloom! If you have ever experienced winter, then you will have spring! If you have dreams, then spring will definitely not be far away; if you are giving, then one day you will have flowers blooming in the garden.

Hello everyone, today XM Foreign Exchange will bring you "[XM Foreign Exchange Official Website]: Daily line rises and reverses the hammer head, try to short when gold and silver are high." Hope it will be helpful to you! The original content is as follows:

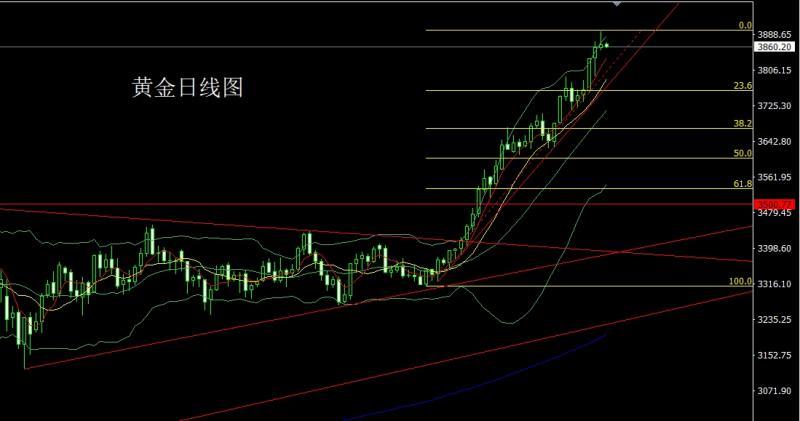

Yesterday, the gold market surged and fell. After the opening in the morning, the market slightly fell back, and the market rose, and the market rose, and the market fell rapidly. The daily line was at the lowest point of 3852.7. The market rose, and the market fell sharply. The daily line reached the highest point of 3895.7. After the market rose and fell. The daily line finally closed at the 3865.6. After the market was very long with an upper shadow line. The inverted hammer head pattern closed, and after such a pattern ended, the daily line initially encountered obstacles. At the point, the long 3325 and 3322 below were long and 3377 and 3385 long and 3563 last week reduced positions and the stop loss followed at 3650. Today, 3885 tried to conservative 3890 short stop loss 3896 below the target 3862 and 3852, and fell below to 3843 and 3836-3827.

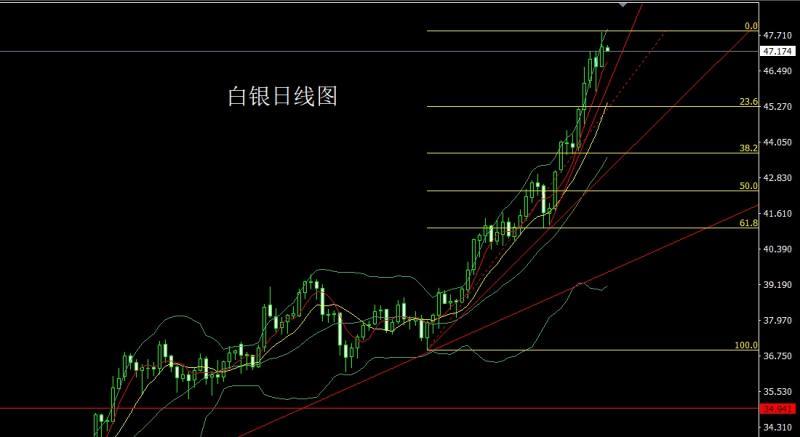

The silver market opened at 46.639 yesterday and the market fell slightly. After giving the position of 46.597, the market fluctuated strongly. The daily line reached the highest position of 47.826 and the market consolidated. The daily line finally closed at 47.309. Then the daily line closed with a medium-positive line with a long upper shadow line. After this mentality ended, the long position of 37.8 and the long position of 38.8 below were reduced and the stop loss followed up at 42. The stop loss was followed up at 44.8 after reducing positions at 44.6 last Friday.Today's 47.6 short stop loss is 47.85, and the target is 47 and 46.6 and 46.3-461.

European and American markets opened at 1.7349 yesterday and the market first rose and gave the position of 1.17785. Then the market surged and fell. The daily line was at the lowest point of 1.17144. The market consolidated. The daily line finally closed at 1.17289. The market closed with a shooting star with a very long upper shadow line. After this pattern ended, today's short stop loss of 1.17650 was 1.17850, and the target was 1.17200 and 1.17000 and 1.16800-1.16600.

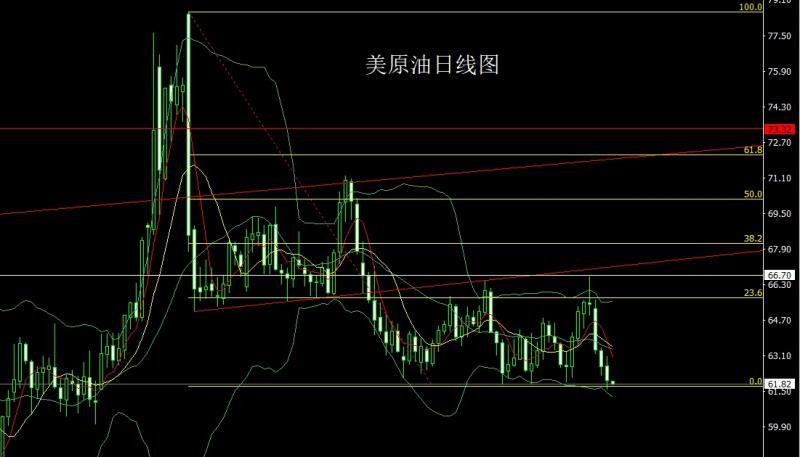

The US crude oil market opened at 62.62 yesterday and then the market first rose and gave the position of 63.09. The market fell strongly. The daily line was at the lowest point of 61.56. The market consolidated. The daily line finally closed at 61.98. Then the market closed with a mid-yin line with an upper and lower shadow line. After this pattern ended, today, the target below 62.3 was short and the stop loss was 63.8. The target below 61.5 and 61 and 60.5-60.

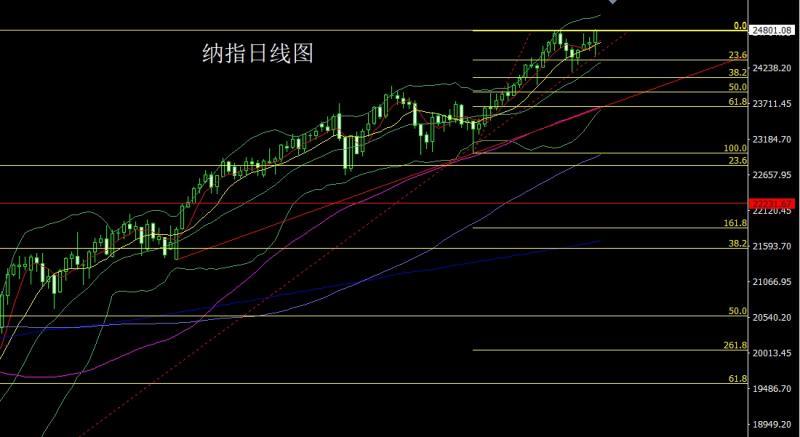

Nasdaq index market opened at 24621 yesterday and then fell back, giving the position of 24409.52, and then the market rose strongly. The daily line reached the highest point of 24814.06, and the market consolidated. The daily line finally closed at 24786.02, and the market closed with a large positive line with a very long lower shadow line. After this pattern ended, the stop loss of more than 24650 today was 24600, with a target of 24750 and 24815, and the break of 24850 and 24900.

The fundamentals, yesterday's fundamentals, the number of ADP employment in the United States unexpectedly decreased by 32,000, the largest decline since March 2023, and the market expected to grow by 50,000. Traders raised bets on the Fed's two further interest rate cuts this year. On the first day of the U.S. government shutdown, the Senate once again rejected the temporary appropriations bill and will suspend voting on the 2nd. The U.S. Vice President said he did not think the government shutdown would last for a long time. U.S. administration and budget said it suspended $18 billion in infrastructure funding in New York City. Layouts will occur within the next one to two days. Fitch: The U.S. government shutdown will not have an impact on U.S. sovereign rating in the short term. S&P: The US government shutdown may drag GDP by 0.1-0.2 percentage points per week. Today's fundamentals focus mainly on the number of initial unemployment claims in the United States from 20:30 to September 27 and the monthly rate of US factory orders in August at 22:00. However, due to the shutdown of the US government, it www.xmtraders.comes from US economic analysisSeveral key economic data from the Bureau (BEA), Bureau of Labor Statistics (BLS), Census Bureau and the US Department of Agriculture may be postponed, including but not limited to: non-farm employment reports, U.S. GDP data, CPI reports and agricultural reports, etc., whichever is subject to actual conditions.

In terms of operation, gold: 3325 and 3322 long below and 3377 and 3385 long last week and 3385 long last week and 3563 long last week, and the stop loss followed by holding at 3650. Today, 3885 tried to short 3890 short stop loss 3896. The target below is 3862 and 3852, and the target below is 3843 and 3836-3827.

Silver: 37.8 long and 38.8 long below and 38.8 long below and 42 held at 42. Last Friday, the stop loss followed by the 44.6 long position reduction at 44.8, and today's short stop loss at 47.85, the target is 47 and 46.6 and 46.3-461.

Europe and the United States: 1.17650 short stop loss today 1.17850, the target is 1.17200 and 1.17000 and 1.16800-1.16600.

U.S. crude oil: 63.8 short stop loss today The target is 61.5 and 61 and 60.5-60.

Nasdaq Index: Today's 24650 stop loss is 24600, the target is 24750 and 24815, and the break is 24850 and 24900.

The above content is all about "[XM Forex Official Website]: Daily high and reverse hammer head, gold and silver try to short when they are high". It is carefully www.xmtraders.compiled and edited by the editor of XM Forex. I hope it will be helpful to your trading! Thanks for the support!

Due to the author's limited ability and time constraints, some content in the article still needs to be discussed and studied in depth. Therefore, in the future, the author will conduct extended research and discussion on the following issues:

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here