Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- 【XM Forex】--USD/PKR Analysis: Trends Higher Amid Controlled Market

- 【XM Group】--USD/MXN Forecast: Dollar on the Verge of Smashing the Peso

- 【XM Group】--USD/INR: Relative Stability as More Potential Reactions Lurk

- 【XM Market Analysis】--USD/MXN Monthly Forecast: February 2025

- 【XM Market Review】--EUR/USD Forex Signal: Bears Testing $1.0500 Again

market analysis

Daily spindle makes pregnancy line, white clothes cross the river with more gold and silver

Wonderful Introduction:

If the sea loses the rolling waves, it will lose its majesty; if the desert loses the dancing of flying sand, it will lose its magnificence; if life loses its real journey, it will lose its meaning.

Hello everyone, today XM Foreign Exchange will bring you "[XM Foreign Exchange Official Website]: Daily spindle makes pregnancy lines, white clothes cross the river with more gold and silver". Hope it will be helpful to you! The original content is as follows:

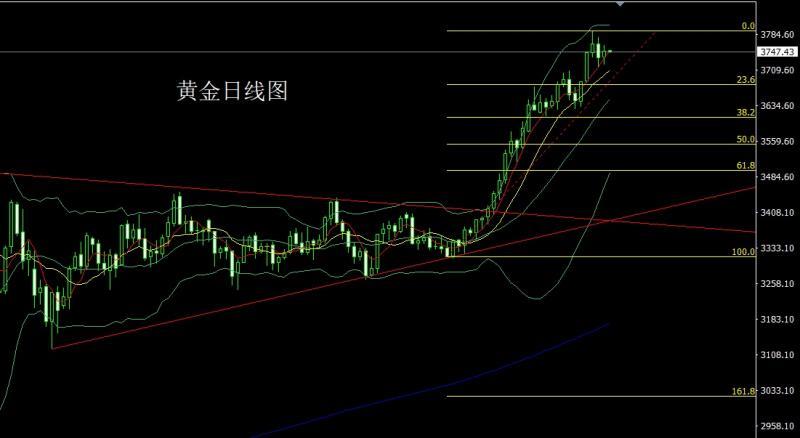

Yesterday, the gold market opened at the early stage of 3737 and then the market first rose, and then the market fell rapidly, and then the market rose strongly. The daily line reached the highest position of 3761.7 and then the market fell strongly during the start of the US session. The daily line was at the lowest position of 3721.6 and then the market rose at the end of the trading session. The daily line finally closed at the 3748.9 position and the market was in a strong position. A spindle pattern with equal length of upper and lower shadows closed, and after such a pattern ended, the long 3325 and 3322 below were long and 3377 and 3385 long and 3563 last week reduced positions and the stop loss followed at 3590. Today, 3728 long and 2725 long stop loss 3721, the target is 3758 and 3765 and 3772 and 3780-3785.

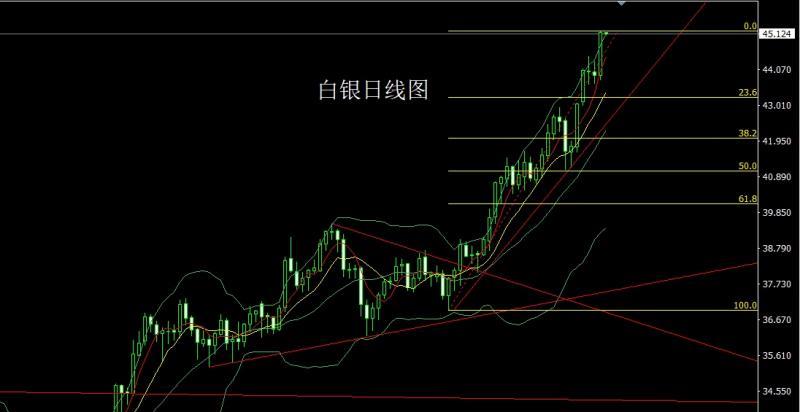

The silver market opened at 43.894 yesterday and the market fell first. The market rose strongly. The daily line reached the highest position of 45.221 and then the market consolidated. After the daily line finally closed at 45.174, the daily line closed with a saturated large positive line with a slightly shadow line. After the pattern of this line ended, the long 37.8 below and the long 38.8 below and the long 38.8 on Friday reduced positions and the stop loss followed up at 42. Today's 44.6 long stop loss is 44.35, and the target is 45.2 and 45.6 and 47.

European and American markets opened at 1.17381 yesterday and the market first rose to give the daily high of 1.17537. The market fell strongly. The daily line was at the lowest point of 1.16443 and then consolidated. After the daily line finally closed at 1.16648, the daily line closed with a large negative line with an upper and lower shadow line. After this pattern ended, today's short stop loss of 1.17150 is 1.17350, and the target is 1.16500 and 1.16300 and 1.16000.

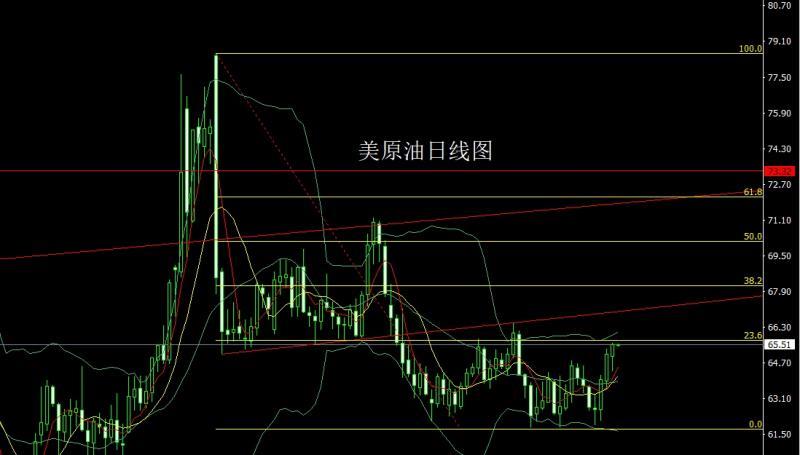

The U.S. crude oil market opened at 65 yesterday and the market fell first. The daily line was at the lowest point of 64.3 and then the market rose strongly. The daily line reached the highest point of 65.6 and then the market consolidated. After the daily line finally closed at 65.52, the daily line closed in a hammer head pattern with a long lower shadow line. After this pattern ended, the long 62.2 below and the long 64.4 below and the long 64.4 yesterday reduced positions and the stop loss followed at 64.4, and today's 64.9 long stop loss 64.4, the target is 65.6 and 66.2 and 66.6 and 67-67.5.

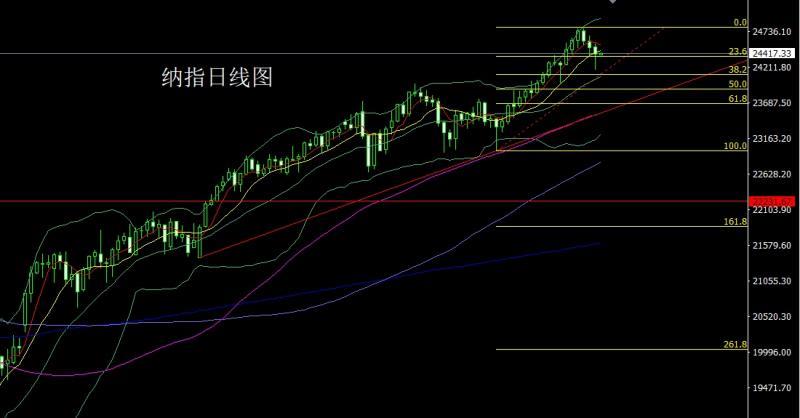

The Nasdaq market opened at 24507.37 yesterday and then rose first. The market first gave a position of 24552.66. Then the market fluctuated and fell. The daily line was at the lowest point of 24180.25 and then rose at the end of the trading session. The daily line finally closed at 24401.68. Then the market closed in a hammer head with a very long lower shadow line. After this pattern ended, the early trading first gave a short stop loss of 24500. The target below looked at 24400 and 24300-24250.

Fundamentals, yesterday's fundamentals The number of initial unemployment claims in the United States to September 20 recorded 218,000, the lowest since the week of July 19, 2025, and the previous value was revised from 231,000 to 232,000. The number of initial jobless claims released by the U.S. fell to its lowest level since mid-July, highlighting that businesses remain cautious about layoffs. Benefiting from consumer spending, the U.S. GDP growth rate in the second quarter hit the fastest record in nearly two years. Local Fed officials spoke continuously, and Logan called for reform of the interest rate benchmark to replace the federal funds rate with a more efficient three-party general interest rate (TGCR), because the former had a transaction size of about $1 trillion per day and the latter was $100 billion per day. She said this move was a technical adjustment and we should be prepared for danger and reform as soon as possible. Bowman said he should now turn to employment rather than inflation. Schmid said the more balance sheet shrinks, the better. Today's fundamentals are the key to this week, focusing on the beauty at 20:30The annual rate of the core PCE price index in August is expected to be 2.9% in this round. Look at the final value of the University of Michigan Consumer Confidence Index in September at 22:00 and the expected final value of the first-year inflation rate in September.

In terms of operation, gold: 3325 and 3322 long below and 3377 and 3385 long last week, and 3563 long last week, and the stop loss followed by holding at 3590. Today, 3728 long conservative 2725 long stop loss 3721, and the target is 3758 and 3765 and 3772 and 3780-3785.

Silver: 37.8 long below and 37.8 long last Friday, and the stop loss followed by holding at 42. Today's 44.6 long stop loss is 44.35, the target is 45.2 and 45.6 and 47.

Europe and the United States: Today's 1.17150 short stop loss is 1.17350, the target is 1.16500 and 1.16300 and 1.16000.

US crude oil: The long position of 62.2 below and the long position of 64.4 yesterday's 64.4, the target is 64.4, the target is 65.6 and 66.2 and 66.6 and 67-67.5.

Nasdaq: The first pull-up in the morning session gave 24500 short stop loss 24550, and the target is 24400 and 24300-24250 left the market and backhand long.

The above content is all about "[XM Forex Official Website]: Daily spindle makes pregnancy lines, white clothes cross the river with lots of gold and silver". It is carefully www.xmtraders.compiled and edited by the editor of XM Forex. I hope it will be helpful to your transactions! Thanks for the support!

After doing something, there will always be experience and lessons. In order to facilitate future work, we must analyze, study, summarize and concentrate the experience and lessons of previous work, and raise it to the theoretical level to understand it.

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here