Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- 【XM Market Review】--EUR/USD Forecast: Euro Drops on Tariff News

- 【XM Market Review】--Gold Forex Signal: Reaching Towards the All-Time High

- 【XM Forex】--AUD/USD Forex Signal: Aussie Retreats Below Key Support Level

- 【XM Forex】--ETH/USD Forecast: Ethereum Awaits Momentum

- 【XM Market Analysis】--GBP/USD Forex Signal: Crash to Continue Amid BoE and Fed D

market analysis

Gold rose by more than $60, and the Federal Reserve faced the "most dangerous" weeks!

Wonderful introduction:

A clean and honest man is the happiness of honest people, a prosperous business is the happiness of businessmen, a punishment of evil and traitors is the happiness of chivalrous men, a good character and academic performance is the happiness of students, aiding the poor and helping the poor is the happiness of good people, and planting in spring and harvesting in autumn is the happiness of farmers.

Hello everyone, today XM Forex will bring you "[XM Forex Official Website]: Gold rose by more than $60, and the Federal Reserve faces the "most dangerous" weeks!". Hope it will be helpful to you! The original content is as follows:

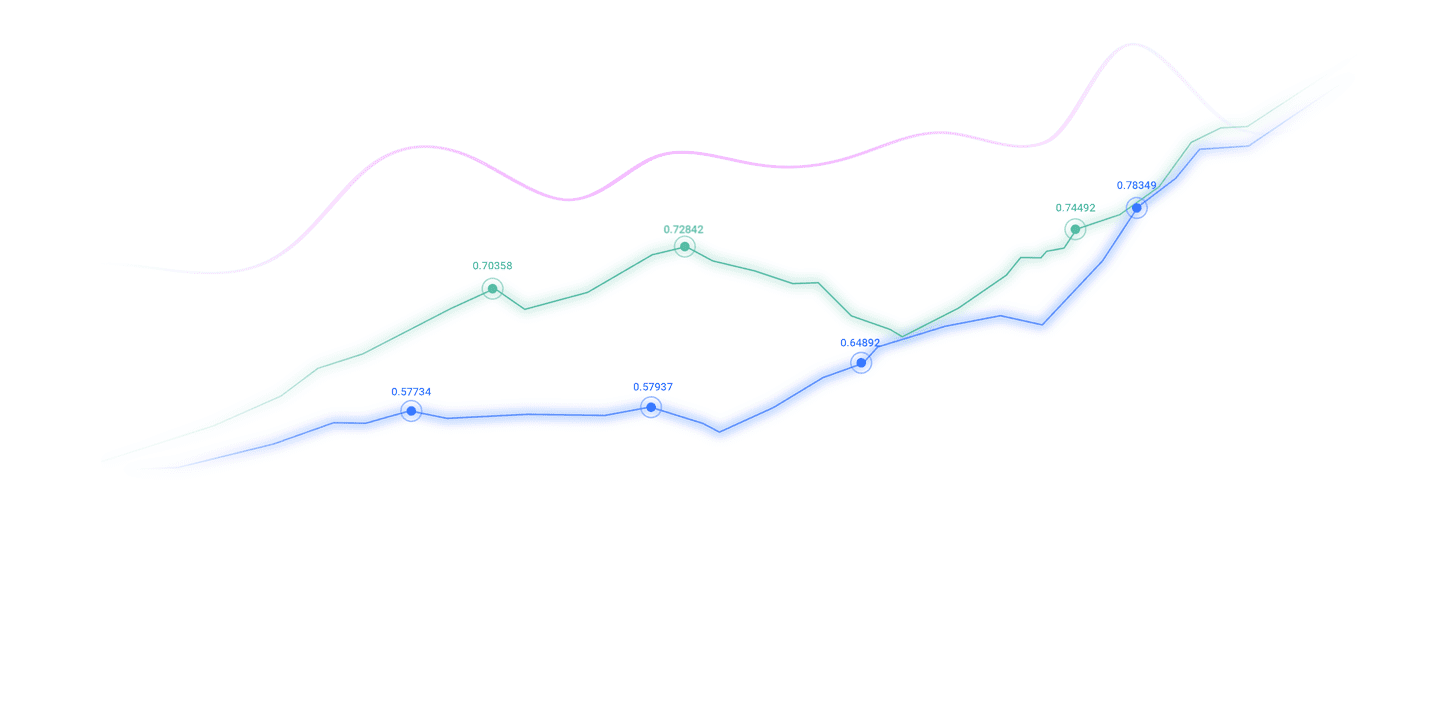

On September 23, spot gold was trading around $3744.18/ounce. The gold price once again hit a record high of $3748.62/ounce on Monday, driven by the rising expectations of further interest rate cuts in the United States and the continued safe-haven demand under political uncertainty. U.S. crude oil traded around $62.30 a barrel, and oil prices closed slightly lower on Monday as concerns about oversupply outweighed the impact on geopolitical tensions in Russia and the Middle East.

The dollar ended on Monday for three consecutive gains against the euro and Swiss franc as investors digested a series of www.xmtraders.comments from Fed officials on its latest monetary policy stance.

The U.S. dollar hovered near levels before the Fed decided to start cutting interest rates last week. Analysts say the current pricing is consistent with the Federal Reserve’s message, which emphasizes that growing concerns about the U.S. labor market are the main drivers of policy.

BNY's head of market macro strategy said BobSavage. The lack of important data before the release of core personal consumption expenditure (PCE) inflation data on Friday has led investors to rethink the Fed's interest rate cuts and plans for the future.

The US dollar fell 0.38% against the Swiss franc in New York to 0.792, and the trend will end the three consecutive trading days of gains. St. Louis Federal Reserve Chairman Mousalem said on Monday that he supported the Fed's decision to cut interest rates at last week's meeting, believing it was a preventive move to protect the job market. But he also pointed out that given that inflation is still above the Fed's 2% target, there may be "limited" room for further interest rate cuts.

Federal Director Milan said on Monday that changes in immigration, taxation and regulatory policies will inevitably lower potential U.S. interest rates and keep current monetary policy far behindMore restrictive than what is needed to keep inflation at the Fed's 2% target.

Milan expressed opposition last week when the Federal Reserve lowered the benchmark interest rate by one quarter percentage point, believing that it should be lowered by half a percentage point. Federal Reserve Chairman Powell will speak on Tuesday. "The data this week is relatively small, and the U.S. second-quarter earnings season has basically ended, and it may be difficult for traders to find direction for most of the week, besides worrying about new ‘emergencies’ and speeches from Fed officials starting today." U.S. President Trump repeatedly criticized the Fed, urging it to cut interest rates more aggressively.

Marc Chandler, chief market strategist at BannockburnForex, New York, said: "We saw a strong rebound in the US dollar after the FOMC meeting, but this rebound was a bit stagnant. I thought the US dollar would have more gains before the next batch of employment data was released. There was not much economic data this week, but it is worth noting that at the FOMC meeting, there were great differences in opinions from all parties, and more than half of the Fed members will speak this week, and Powell's speech may be the focus tomorrow."

Asian Markets

The latest data released by S&P Global Global on Tuesday showed that the initial value of the S&P Global Manufacturing Purchasing Managers Index (PMI) in Australia was 51.6 in September, and the previous value was 53.0.

Australia's S&P Global Services Purchasing Managers Index fell from its previous value of 55.8 to 52.0 in September, while the www.xmtraders.comprehensive Purchasing Managers Index fell from its previous value of 55.5 to 52.1 in September.

European Market

A post in the ECB Economic Bulletin shows that euro zone consumers are already adjusting their consumption patterns to deal with U.S. tariffs. The survey shows that 26% of respondents have abandoned U.S. products, while 16% say they have reduced their overall spending.

The ECB points out the differences between different income groups: high-income households are more likely to replace U.S. goods, while low-income households tend to cut total spending. Most of these reductions are concentrated on discretionary purchases, with essentials being basically protected.

In addition to the current spending model, the ECB warns that households are also raising inflation expectations, including long-term views. This suggests that consumers believe that the price pressures associated with tariffs are more than just temporary.

U.S. Market

St. Louis Fed Chairman Mousalem said he supported a 25 basis point rate cut last week as a "preventive move" to protect the labor market from further weakening. However, he emphasized in a speech that before monetary policy faces the risk of "over-easing easing", there is limited room for further easing.

He stressed that while the Fed could provide insurance for weak labor markets, it also had to “incline to sustained inflation above targets.”

Musalem added that he will be inThe www.xmtraders.coming months continue to update his economic outlook to strike a proper balance between employment and inflation.

The above content is all about "[XM Forex Official Website]: Gold rose by more than $60, and the Federal Reserve faced the "most dangerous" weeks!", which was carefully www.xmtraders.compiled and edited by the editor of XM Forex. I hope it will be helpful to your trading! Thanks for the support!

Only the strong know how to fight; the weak are not qualified to fail, but are born to be conquered. Step up to learn the next article!

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here