Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- 【XM Market Analysis】--GBP/USD Analysis: Forecast for 2025

- 【XM Group】--SP 500 Forecast: Takes Off for Monday Session

- 【XM Forex】--BTC/USD Forex Signal: Bullish Flag Points to a Jump to ATH

- 【XM Decision Analysis】--USD/CAD Forecast: Continues to Eye Massive Barrier

- 【XM Market Review】--USD/CAD Forecast: Rises Amid BoC Rate Cut Risks

market analysis

The weekly range is to be continued, and gold and silver are short this week and it will be long.

Wonderful introduction:

A clean and honest man is the happiness of honest people, a prosperous business is the happiness of businessmen, a punishment of evil and traitors is the happiness of chivalrous men, a good character and academic performance is the happiness of students, aiding the poor and helping the poor is the happiness of good people, and planting in spring and harvesting in autumn is the happiness of farmers.

Hello everyone, today XM Foreign Exchange will bring you "[XM Official Website]: The weekly range will be continued, and gold and silver will be short and will be long this week." Hope it will be helpful to you! The original content is as follows:

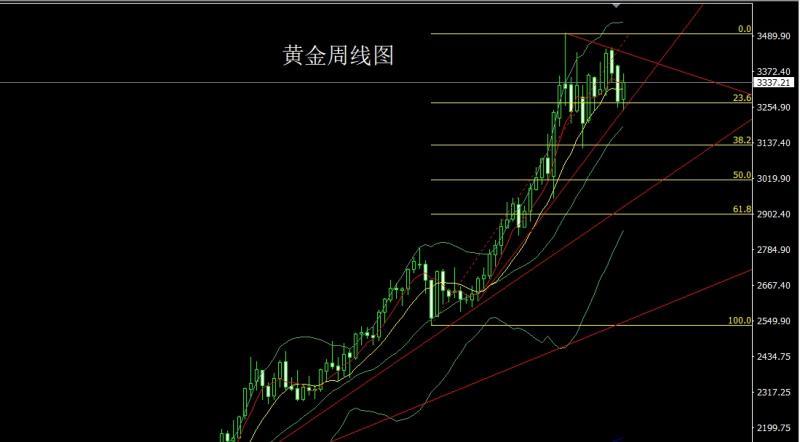

Last week, gold opened high at the beginning of the week at 3280.9 and then fell first. The weekly line was at the lowest point of 3245.8 and then the market rose strongly due to the support and fundamentals of this round of trend line. By the early Thursday, the weekly line reached the highest position of 3366 and then fell strongly by the strong non-agricultural market. Friday's market was consolidated under the influence of holidays. After the weekly line finally closed at 3337.2, the weekly line closed with a medium-positive line with an upper and lower shadow line. After this pattern ended, today's market continued the range. At the point, the short position of 3342 was reduced last Friday and the stop loss was still at 3346. Today, it first rose 3342 and still had a short stop loss 3346. The target below 3330 and 3322, and the support below 3310 and 3300-3292.

The silver market opened at the beginning of last week at 36.011 and then fell first. The weekly line was at the lowest point of 35.362 and then the market rose strongly. The weekly line reached the highest point of 37.071 and then the market consolidated. After the weekly line finally closed at 36.93, the weekly line closed with a large positive line with a long lower shadow line. After such a weekly line pattern ended, the silver market had a technical demand for an upward break this week. At the point, the high opening today gave a short stop loss of 37.45. The target below looked around 36.9 and 36.7.

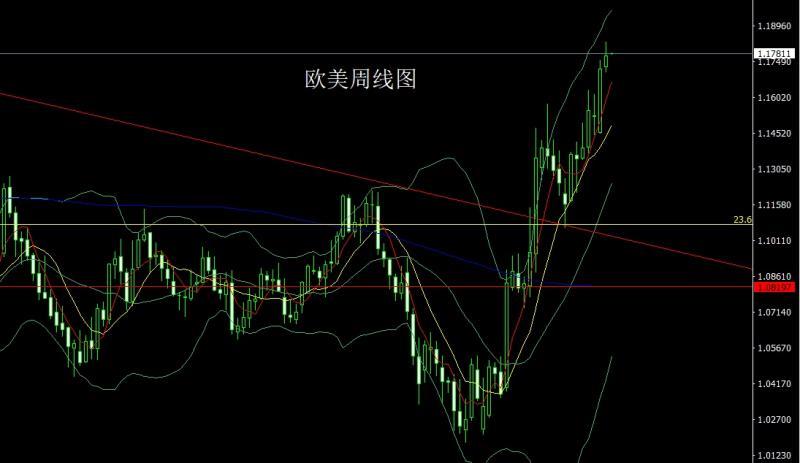

The European and American markets opened at 1.17279 last week and the market fell first. The weekly line was at the lowest point of 1.17036 and then the market rose strongly. The weekly line reached the highest point of 1.018301 and then the market consolidated. The weekly line finally closed at 1.17736 and then the market ended with a very long inverted hammer head pattern. After this pattern ended, it first pulled up today to give a short stop loss of 1.18100 1.8250. The target below is 1.17600 and 17400.

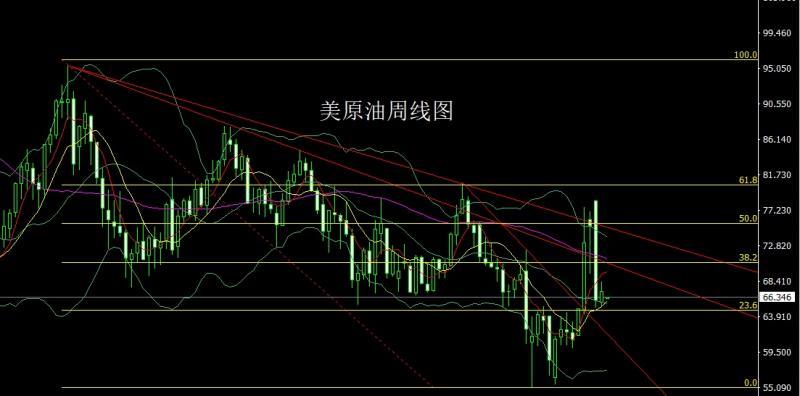

The US crude oil market consolidated in the range last week. At the beginning of the week, the market fell first. The weekly line was at the lowest point of 65.23 and then the market rose strongly. The weekly line reached the highest point of 68.31 and then fluctuated and fell in the late trading. After the weekly line finally closed at the 67.14 position, the weekly line closed with a small positive line with an upper shadow line slightly longer than the lower shadow line. After this pattern ended, the 67.1 short stop loss 67.5 was opened lower than the target below 66.5 and 66 and 65.5.

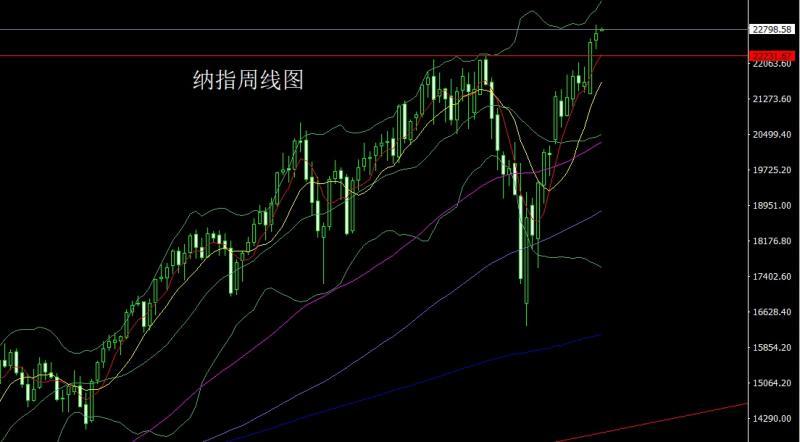

Nasdaq market continued its upward trend last week. At the beginning of the week, the market fell first, and then gave the position of 22351.9. The market fluctuated strongly. The weekly line reached the highest position of 22900.4 and then fell back at the end of the market. After the weekly line finally closed at the position of 22705.26, the weekly line closed with a high spindle pattern of up and down shadows. After this pattern ended, it first rose 22850 today, the bottom target of 22950 is 22600 and 22500.

Fundamentals, last week's fundamentals, the U.S. non-farm employment increased by 147,000 in June, and the unemployment rate unexpectedly dropped to 4.1%, both significantly better than expected. After the data was released, the market gave up its bet on the Federal Reserve's interest rate cut in July and cut interest rates in September. The probability of the bill also fell to about 80%, and the U.S. House of Representatives passed the "Big and US" tax and expenditure bill promoted by the president with a vote of 218 votes in favor and 214 votes against. The U.S. president is scheduled to sign the bill on July 4, the U.S. "Independence Day" to make it effective. The final version of the bill is 869 pages long and is about $3.4 trillion. Supporters believe that the bill will benefit all income classes through tax cuts and promote the "takeoff" of the economy. However, Democrats criticized it as "robbing the poor and helping the rich" and pointed out that the bill will cut federal health insurance, causing 12 million people to lose health insurance in the next decade. But no matter what, the U.S. economic indicators currently show that the U.S. economy is still acceptable. Against the backdrop of insufficient momentum for the Federal Reserve to cut interest rates, the gold and silver market is under pressure. The fundamentals of this week are the mainPay attention to the US Global Supply Chain Pressure Index in June at 22:00 today. On Tuesday, the RBA announced its interest rate decision at 12:30. Then, RBA Chairman Brock, who watched 13:30, held a monetary policy press conference. , pay attention to the 1-year inflation expectation of the US New York Fed in June at 23:00 in the evening. On Wednesday, we will pay attention to China's June CPI annual rate at 9:30. In the evening, we will see the US wholesale monthly rate in May at 22:00 and the US-to-July 4 EIA crude oil inventories for the week of July 4 and the US-Oklahoma Cushing crude oil inventories for the week of July 4 and the US-to-July 4 EIA strategic oil reserve inventory for the week of July 4. Thursday saw the Federal Reserve release minutes of the monetary policy meeting at 2:00 a.m. At night, we will pay attention to the number of people who requested initial unemployment benefits from the United States to July 5th from 20:30 in the evening, and at 14:00 in the UK on Friday, we will pay attention to the monthly GDP rate of May in three months.

In terms of operation, gold: The short position of 3342 was reduced last Friday, and the stop loss was still at 3346. Today, the target of 3342 was first raised and the short position was still at 3346. The target below was 3330 and 3322, and the support below fell below 3310 and 3300-3292.

Silver: Opening high today gives a short stop loss of 37.25 at 37.45, and the target below looks around 36.9 and 36.7.

Europe and the United States: Today, we will first pull up and give a short stop loss of 1.18100 1.8250, and the target below will look at 1.17600 and the sum. 17400.

US crude oil: 67.1 short stop loss 67.5, look at 66.5 and 66 and 65.5.

Nasdaq: Today, let's rise 22850 first, look at 22600 and 22500.

The above content is about "[XM official website]: The weekly range is to be continued, gold and silver short will be long this week" is carefully www.xmtraders.compiled and edited by the editor of XM Forex. I hope it will be helpful to your trading! Thanks for the support!

Due to the author's limited ability and time constraints, some content in the article still needs to be discussed and studied in depth. Therefore, in the future, the author will conduct extended research and discussion on the following issues:

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here