Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- 【XM Decision Analysis】--EUR/USD Analysis: Downward Trend Strong

- 【XM Market Analysis】--USD/CAD Forecast: Stagnates Amid Uncertainty

- 【XM Market Review】--Gold Monthly Forecast: January 2025

- 【XM Forex】--GBP/USD Forex Signal: Inverse Head and Shoulders Pattern Forms

- 【XM Forex】--Gold Forecast: Gold Continues to Meander Around 50 Day EMA

market news

Trade benefits cannot meet the hidden financial concerns, and the storm of US dollar depreciation is about to break out?

Wonderful introduction:

Optimism is the line of egrets that are straight up to the blue sky, optimism is the thousands of white sails beside the sunken boat, optimism is the lush grass that blows with the wind on the head of the parrot island, optimism is the falling red spots that turn into spring mud to protect the flowers.

Hello everyone, today XM Foreign Exchange will bring you "[XM Official Website]: Trade benefits cannot resist financial concerns, is the storm of US dollar depreciation about to break out?" Hope it will be helpful to you! The original content is as follows:

Asian market market

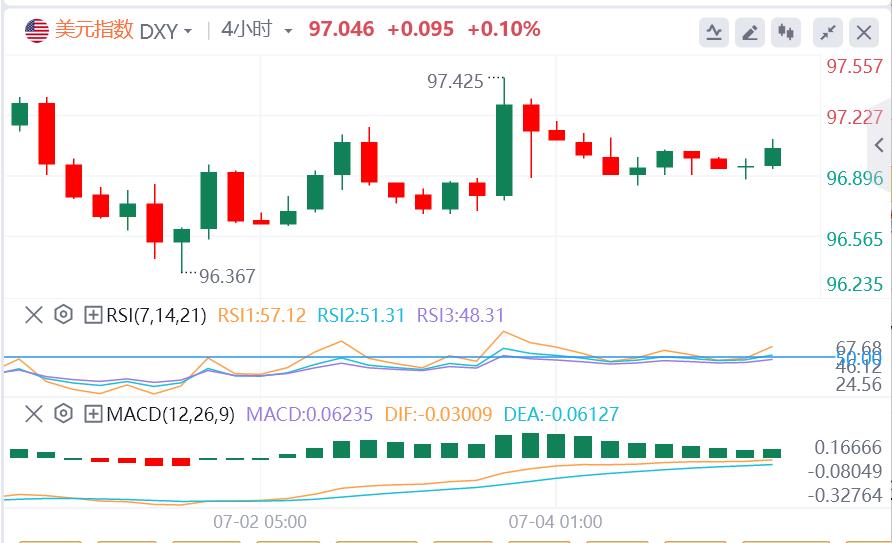

Last Friday, the US dollar index fell due to the "Big and US bill" promoted by Trump, and the US dollar index has fallen. As of now, the US dollar price is 97.04.

Tariff policy development:

①Trump: 12 or 15 letters related to tariffs may be sent on Monday; some agreements have been reached. ② European and American Finance Minister Besent: Several major agreements are close to being reached; if the country receiving the tariff letter fails to reach an agreement, the tax rate will return to April level from August 1. ③US Secretary of www.xmtraders.commerce Lutnik: Tariffs will www.xmtraders.come into effect on August 1, and Trump "is now formulating tax rates and agreements." ④ White House economic adviser Hassett also said that some trade negotiations may exceed the deadline. ⑤ According to British media: The United States made a request at the last minute, threatening to impose a 17% tax on European agricultural products. There are reports that the EU has failed to make a breakthrough in trade talks with the United States. ⑥ South Korea-US trade representatives negotiated in the United States to extend the plan to exempt reciprocal tariffs. ⑦ Cambodia announced an agreement with the United States on tariff negotiations. ⑧ It is reported that negotiations on the India-US small trade agreement have been www.xmtraders.completed, and the average tariff rate may be 10%. ⑨ Thailand is reportedly providing more concessions to the United States to avoid a 36% tariff.

Trump signs the "Big and American" tax and expenditure bill.

Musk announced the establishment of the "American Party". Trump responded that this behavior was extremely absurd. Becente believes that Musk should stay away from politics. If he really formed a party, it might beWill win some votes.

U.S. media revealed that US Secretary of Defense Hegsey once again suspended the transportation of weapons to Ukraine.

Israel and Hamas negotiated on Sunday, and the Israeli side called Hamas' demands "unacceptable." Two Palestinian officials familiar with the round of negotiations revealed that the first round of indirect ceasefire negotiations held by Israel and Hamas in Qatar ended in vain.

The EU will establish emergency reserves of key minerals to deal with geopolitical risks. OPEC+ agreed to increase daily production by 548,000 barrels in August, further accelerating production growth.

Summary of institutional views

Dutch International: Continued slowdown in inflation opens a window for the RBA to cut interest rates

Dutch International Bank said it is expected that the RBA will lower the cash rate by 25 basis points to 3.6% at its Tuesday meeting, as recent growth and inflation data are weaker than expected. Australia's overall inflation rate fell from 2.4% in April to 2.1%, approaching the lower limit of the central bank's target range of 2-3%. In addition, the latest monetary policy statement of the RBA shows that the voluntary turnover rate has declined and the focus of wage negotiations has shifted to employment security demands, which may slow down wage growth than current expectations. Considering that the downward risks of growth and inflation dominate, we will expand the expected rate cut in 2025 by 25 basis points, and the final value of the cash rate is expected to reach 3.1% by the end of the year. The global tariff situation has not dissipated, while overall and core inflation have established a downward trend, and is expected to remain around the median range of 2-3% in the next few quarters.

UKI Bank: The unemployment rate in the United States may rise to... indicates that the Federal Reserve will cut interest rates X times this year

As the inflation caused by tariffs has an adverse impact on total U.S. demand and intensified economic uncertainty, the unemployment rate is expected to rise to 4.5% by the end of this year. However, it is important that the rise in unemployment rate is relatively small for three reasons. First, we expect the U.S. economy to avoid recession. The current extremely high level of economic uncertainty is expected to ease over time, financial conditions relax after market turmoil in April, and the large US bill will moderately support economic activity. Second, a significant reduction in immigration and a slight increase in deportations will reduce the labor supply, thus putting downward pressure on the unemployment rate. Third, tariffs may damage U.S. labor productivity growth, thereby supporting labor demand. We still expect the Fed to cut interest rates only once this year in December.

Fasing Bank: The deadline for reciprocity is approaching! Many difficult problems in the EU have not yet been solved. How will the trade game end?

This week, the focus will turn to the July 9 deadline for the extension of the peer tariffs. The EU now appears ready to accept an unequal 10% U.S. tariff without any retaliation, while hoping to obtain quotas for steel, aluminum and automobiles and reduce tariffs in certain industries (pharmaceuticals, alcohol, aircraft). There are reports that the Trump administration has begun to announce reciprocal tariffs on individual countries, but we expect negotiations with the EU to continue next week, with industry tariffs and non-tariff barriers (and possible digital service tax) will be particularly difficult.

At this stage, we may see more controversy within the EU, as different countries may give different priorities to different industries. In addition, there are also reports that large European automakers and pharmaceutical www.xmtraders.companies have negotiated with the U.S. government separately, hoping to invest in the U.S. in exchange for lower tariffs. If the EU and the U.S. cannot reach an agreement next week, these negotiations may restart and strengthen further, and there is a high risk that the EU may impose counter-tariff measures on the U.S., which may have a greater impact on inflation and economic growth prospects, and the extent of the impact will depend on the duration of the eventual deadlock.

ANZ: Five key outlooks for Trump's tariffs

1. The United States may impose a 10% tariff on all trading partners by the upcoming tariff deadline, and the timetable for reciprocal tariff negotiations may be extended.

2. Given Trump's ambition to reindustrialize the U.S. economy, higher tariffs on certain strategic sectors may continue. 3. The final trade agreement may not be reached by July 9, so some temporary bilateral trade agreements are expected.

4. In these negotiations, the US-EU dialogue is particularly important because it represents the world's largest bilateral trade relationship.

5. If the deadline is not extended or the reciprocal tariffs are expanded, the downside risks of U.S. economic growth and upside risks of inflation may increase.

The above content is all about "[XM official website]: Trade benefits cannot resist financial concerns, is the storm of US dollar depreciation about to break out?" It is carefully www.xmtraders.compiled and edited by the editor of XM Forex. I hope it will be helpful to your transactions! Thanks for the support!

Share, just as simple as a gust of wind can bring refreshment, just as pure as a flower can bring fragrance. The dusty heart gradually opened, and I learned to share, sharing is actually so simple.

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here