Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- 【XM Market Review】--Nasdaq 100 Forecast: Holds Key Support

- 【XM Decision Analysis】--USD/PHP Forecast: US Dollar Powers Higher Against Philip

- 【XM Group】--GBP/USD Forecast: Struggles Against the Dollar

- 【XM Group】--USD/CHF Forex Signal: Climbs after 50 Basis Point Cut by SNB

- 【XM Market Analysis】--BTC/USD Forex Signal: Bullish Pennant Points to a Bullish

market news

The bottom-stripping hammer head needs to rebound, and gold and silver retracement delays low

Wonderful Introduction:

If the sea loses the rolling waves, it will lose its majesty; if the desert loses the dancing of flying sand, it will lose its magnificence; if life loses its real journey, it will lose its meaning.

Hello everyone, today XM Foreign Exchange will bring you "[XM Foreign Exchange Decision Analysis]: The bottom-stripping hammer head needs to rebound, and gold and silver retrace back and delay low long." Hope it will be helpful to you! The original content is as follows:

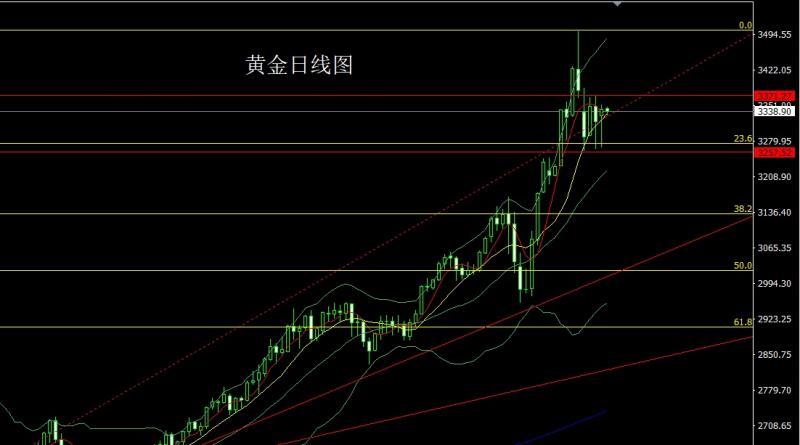

The gold market opened higher at 3330.5 yesterday and then fell back first. The daily line was at the lowest point of 3267.7 and then the market rose strongly. The daily line reached the highest point of 3353.2 and then the market consolidated. The daily line finally closed at 3343.9 and then closed in a hammer head with a very long lower shadow line. After this pattern ended, there was a long demand for today's market. At the point, the short position of 3496 and 3468 and 3442 last week, the stop loss followed at 3400, and the stop loss followed at 3273 yesterday, and the stop loss followed at 3273 today, and the 3305 is conservative 3302 is long and stop loss 3298, the target is 3332 and 3345 and 3353, and the break is 3362 and 3371 for pressure www.xmtraders.competition.

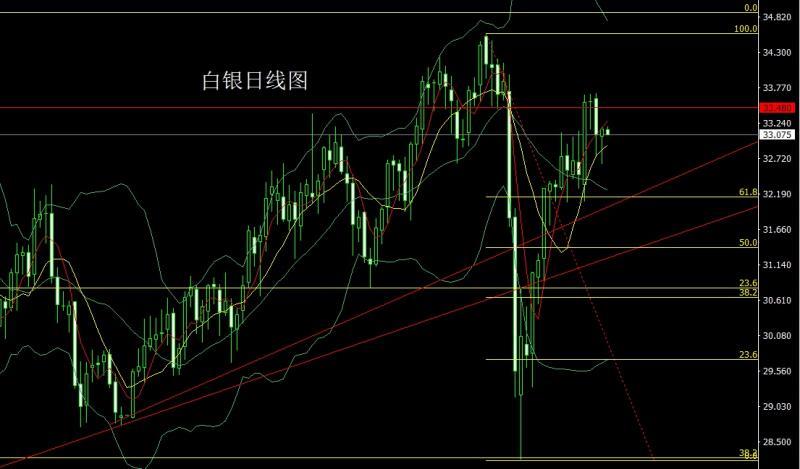

The silver market opened at 33.046 yesterday and then the market rose slightly. The market fell first. The daily line was at 32.642 at the lowest point and the market rose strongly. The daily line reached the highest point of 33.186 and then the market consolidated. The daily line finally closed at 33.153. Then the market closed with a hammer head with an extremely long lower shadow line. After this pattern ended, the target was 32.9 and the target was 32.7. The target was 33.2, and the break was 33.4 and 33.6 pressures.

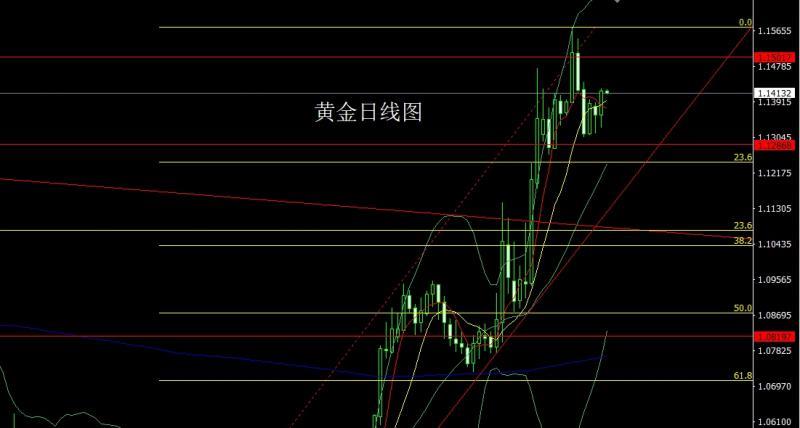

European and American markets opened at 1.13595 yesterday and the market fell first. The daily line was at the lowest point of 1.13284 and then the market rose strongly. The daily line reached the highest point of 1.14251 and then the market consolidated. The daily line finally closed at 1.14180 and then the market closed with a large positive line with a long lower shadow line. After this pattern ended, the market fell back to a long market. At the point, the stop loss of more than 1.13800 today is 1.13600, and the target is 1.14250 and 1.14500 and 1.14700-1.14900.

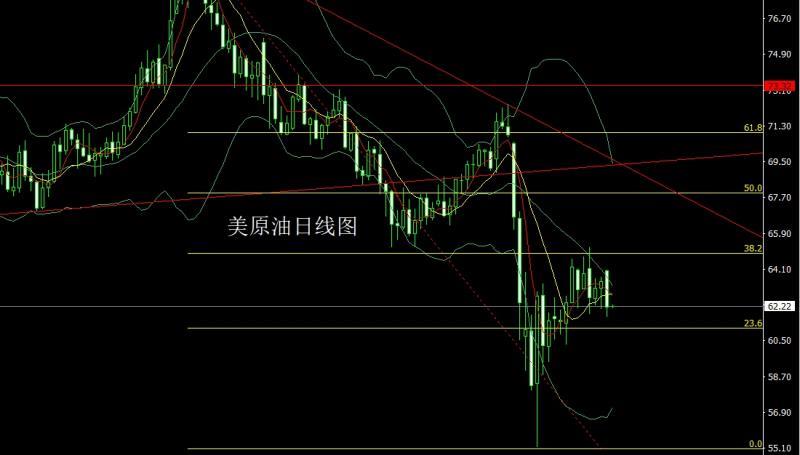

The US crude oil market opened higher at 64.02 yesterday and then rose slightly. The market rose and fell. The daily line was at the lowest point of 61.73 and then the market consolidated. The daily line finally closed at 62.17 and then the market closed with a large negative line with a long lower shadow line. After this pattern ended, 63 short stop loss today was 63.5, and the target below was 62.3 and 61.7, and the falling below was 61.2 and 61.

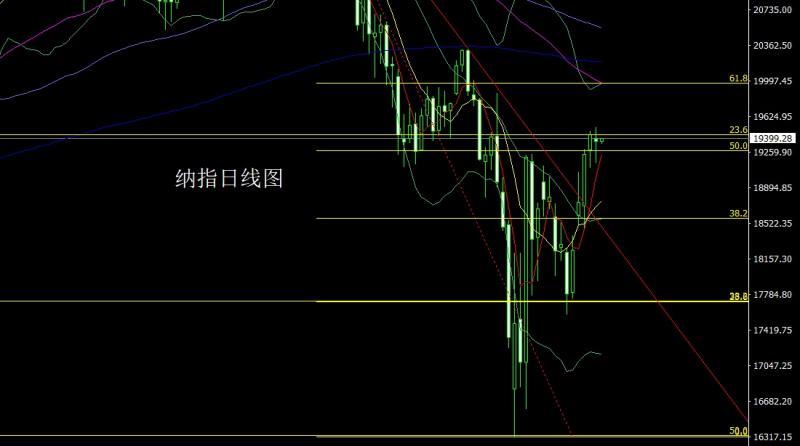

Nasdaq index market opened low yesterday at 19396.12 and then the market fell back to 19283.15 and then the market rose. The daily line reached the highest position at 19521.38 and then the market fell strongly. The daily line finally closed at 19150.53 and then the market rose. The daily line finally closed at 19374.02 and then the market closed with a lower shadow line longer than the upper shadow line. After this pattern ended, the stop loss of 19250 is more than 19150 today, with the target of 19400 and 19500 and 19600 pressure.

Fundamentals, yesterday's fundamentals, the US Dallas Fed Business Activity Index in April was significantly lower than expected, which strengthened the expectations of US economic recession. Against the backdrop of the US index, the gold, silver and non-US markets rose, while India and Pakistan There is still a tense small-scale exchange of fire. There is no sign of expansion at present, but the two sides are actively preparing, so although the South Asian powder keg will not break out in the near future, it needs to be paid attention. In terms of trade war, the American Monthly Interview: The US President believes that no red line will change the tariff policy. US Treasury Secretary: The first trade agreement may be reached as early as this week or next week, and India may be one of the first batch. German Chancellor-elect Merz will urge the US President to cancel all relevant taxes. Today's fundamentals mainly focus on the monthly rate of the US February FHFA House Price Index at 21:00 and the annual rate of the 20 major cities in S&P/CS in February. Then look at the US March JOLTs job openings and the US April Consultative Conference Consumer Confidence Index.

In terms of operation, gold: 3496 and 3468 and 3442 short cuts last weekThe stop loss after position is held at 3400, the stop loss after position is reduced yesterday was held at 3273, and today the 3305 is conservative 3302 is long and stop loss is 3298, the target is 3332 and 3345 and 3353, and the break is 3362 and 3371 for pressure.

Silver: Today's 32.9 long stop loss 32.7. The target is 33.2, and the breaking position is 33.4 and 33.6 pressure.

Europe and the United States: 1.13800 stop loss today is 1.13600, the target is 1.14250 and 1.14500 and 1.14700-1.14900.

U.S. crude oil: 63 short stop loss today is 63.5, the target is 62.3 and 61.7, and the drop is 61.2 and 61.

Nasdaq Index: 19250 stop loss today is 19150 stop loss today, the target is 19400 and 19500 and 19600 pressure.

Yesterday, more than 3273 times

The above content is all about "[XM Foreign Exchange Decision Analysis]: The bottoming hammer head needs to rebound, gold and silver fall back and delay low" is carefully www.xmtraders.compiled and edited by the XM Foreign Exchange editor. I hope it will be helpful to your trading! Thanks for the support!

Only the strong know how to fight; the weak are not qualified to fail, but are born to be conquered. Step up to learn the next article!

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here